2012 State of the Industry: Robotics

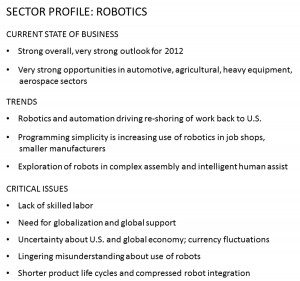

Forecast: Very strong opportunities to expand into job shops and smaller manufacturers, along with continued strength in the traditional automotive, agricultural, heavy equipment and aerospace sectors.

Posted: January 11, 2012

Forecast: Very strong opportunities to expand into job shops and smaller manufacturers, along with continued strength in the traditional automotive, agricultural, heavy equipment and aerospace sectors.

Steve Barhorst

Steve Barhorst

President & COO, Motoman Robotics Division, Yaskawa America, Inc.

Manufacturer of industrial robotic automation for arc welding, assembly, coating, dispensing, material cutting, material handling, material removal, and spot welding applications.

CURRENT STATE OF BUSINESS

Business in 2011 has been quite strong. In conversations with various companies, in or related to our industry, it appears that their business has also been very strong or stable. However, we continually hear concerns from the media and economists that the current state of the economy is tenuous. In addition, recent key manufacturing indices have shown that growth is slowing. In concert with these reports, or as a result of anxiety created by these reports, it appears the state of business, while currently stable, is showing signs of softening.

In 2011 we have seen the most activity from traditional market sectors – automotive, agricultural and heavy equipment. The companies in these sectors are purchasing large numbers of robots and have led the recovery in our industry. The product applications vary, but the most prevalent applications we have seen are welding and material handling.

In looking at opportunities in the near future, we expect these traditional market sectors and applications to continue to represent the majority of industrial robot purchases. We expect other market sectors will continue to increase their utilization of robotics automation, increasing the market size as a whole. Some market sectors we see as being quite active and offering new opportunities are food, material handling, consumer products, medical and pharmaceutical, alternative energy and service robotics. The newer applications that we are seeing the most opportunities in the near term include: high speed handling within an integrated platform, dexterous assembly and applications which require advanced vision capabilities.

We find that more and more companies are looking toward automation to help them solve manufacturing issues, become more efficient and more competitive with low cost labor countries.

MAJOR TRENDS

From a market sector view, we see the trends in the industry in the coming year to be three-fold:

(1) Traditional customers will continue to use proven robotic automation to allow them to increase productivity, quality and reliability.

(2) Traditional customers that are historically heavy robotics users are increasing their exploration of robotic automation into newer applications, such as dexterous (or complex) assembly and intelligent human assist.

(3) Newer, less mature market sectors – historically with few robotic users – are increasingly looking at robotic automation as a means to increase their productivity.

In relation to these market sector trends, from an application standpoint, we see the major trends for the coming year to be as follows: For proven robotic applications, we see innovations that will improve the current processes. A couple of examples of these are advanced seam finding-seam tracking applications which improve weld cycle time, and/or advances in adaptive welding capabilities. Generally, continuous improvement and innovation in proven technologies to increase efficiencies and lower costs.

Enabling robots to perceive their environment through vision and sensor technologies and driving toward closer interaction with humans. We also see a trend toward human scale automation (dual arm robots) for assembly and other applications that can now utilize robotics due to the availability of this type of robot and complementary technologies at cost effective levels. For discrete manufacturing applications (not heavily oriented toward processes), we see a move toward an integrated platform which allows the robot to be programmed through a PLC. We see this to be especially beneficial in market sectors such as food and consumer products.

In the longer term, as companies continue to look for ways to increase productivity and deliver product to market faster and more cost effectively, we see a move toward more open source controls – an array of different control platforms to meet the specific user’s needs; advancements in dexterous robotics with mobile capabilities; and a continued push toward easy-to-use system and teaching capabilities that do not require programming.

In regards to how investments in technology are helping our customers compete, we believe that the recent advancements, as well as expected advancements over the next three-to-five years, will further provide customers with increased efficiencies and lower their manufacturing/assembly/logistics costs. This will enable these customers to more effectively compete with low cost labor countries and help strengthen manufacturing in North America.

In addition, we feel that the recent advancements in technology and expected advancements over the next three-to-five years will open up new markets for robotics and increase the customer base for robotic automation applications, driving toward increased productivity, reliability and decreased costs in these sectors. As an automation company, we welcome and help drive advancements in technology. Our goal is to continually drive innovation to assist the market and our customers to become more efficient.

CRITICAL ISSUES

The industry has experienced strong growth over the last two years, rebounding from the economic downturn in late 2008 and 2009. In addition, new innovations and new market initiatives have increased the market size (users of robotics) over the past couple of years.

From a technology standpoint, we see the market continuing to strengthen and expand with additional technological advancements occurring. We feel that the understanding and acceptance of robotics outside of the traditional market sectors will continue to grow. With that, we believe there are three critical issues facing the industry this year; one which is within our control, and two which are unfortunately issues that are outside of the industry’s control.

The issue which is within our industry’s – or at least the companies operating within our industry – control is the increasing need for globalization and global support. The two issues which are outside of our industry’s control are the uncertainty about the U.S. and global economy, and the related currency fluctuations that have been occurring. While our business is strong, we are monitoring the economic news in anticipation of how it might impact small- and medium-size enterprises, as well as large multi-national corporations.

In regards to globalization and global support, we are a global company with a global sales and support network. We continue to add offices in new locations and implement processes to improve our global communications and global infrastructure. We realize companies are looking to standardize on global platforms where possible for operational efficiencies, flexibility and cost reduction purposes. While these organizations make advances in global development and procurement, we are implementing strategies to be able to work hand-in-hand with them to assist in the development of global automation solutions, as well as seamless global support of such solutions.

While we do not have a significant direct impact on the U.S. economic climate, we do work with our customers to develop automation solutions to improve their efficiencies. In addition, we work to ensure that our operational team, infrastructure and supply chain are all as efficient and agile as possible. This enables us to respond quickly when we anticipate changes in the marketplace, and to continue to deliver a high level of value to our customers and partners. We are continually working to increase automation solutions across many industries to help increase the overall market size for robotics solutions and increase our diversification should an economic downturn occur.

Similarly, to help protect against currency fluctuations, we are diversifying our production capabilities. While our detailed strategy is confidential, we will have production capabilities for different key components of our product offerings in various parts of the world. This will help protect us against significant currency fluctuations, loss of supply due to natural disasters, and, in many cases, will provide our customers with a logistical and support advantage of having the products manufactured in closer proximity to their manufacturing facilities.

Yaskawa America, Inc. Motoman Robotics Division, 100 Automation Way, Miamisburg, OH 45342, 937-847-6200, www.motoman.com.

Joe Campbell

Joe Campbell

Vice President, ABB Robotics & Applications Group

Manufacturer of industrial robots, modular manufacturing systems and service for cutting, forming, welding and joining, surface treatment and finishing, inspection and measuring, and material handling applications for the metal fabrication industry and others.

CURRENT STATE OF BUSINESS

The outlook for the industrial robotics industry in 2012 is very strong, with expectations that overall industry revenues will likely surpass the robust activity we experienced in 2011. We see growth in many automotive programs, from the Big Three to Tier 1 part and component suppliers. New models are coming on-line and car makers are retooling their operations and investing in the robotics needed to build them. We also see significant growth in the general industry sector as well, with aerospace being especially worthy of note.

Regarding robotics specifically in metal fabrication, recent advancements in robotic welding technology have addressed the needs at both ends of the spectrum, from entry level cells targeted at job shops to more intricate, highly engineered systems for heavy, large frame welding.

As it continues to be a challenge to find qualified welders, the growth in robotics in smaller machine shops will continue to be a be a bright spot. This trend is supported by more economical price points for robotic welding systems, and the significant software and controller advancements that have made robots far easier to program. We have developed complete robotic welding systems that are available for as low as $35,000 and can be installed and running in one day.

On the other end of the spectrum we have experienced increased activity in large platform applications, such as welding hulls on ships and other large components. The unmatched endurance of robots, and the highly precise path accuracy and weld consistency achievable through robotic welding have been the main drivers of the growth on the larger, heavy weldment end of the spectrum.

MAJOR TRENDS

From a macro-perspective the advances in robotic automation are beginning to contribute to a trend of “on-shoring” or “re-shoring”, where production stays at home or even returns from low labor cost areas such Eastern Europe, India, Latin America, and China. The predictions of future wage parity between China and the U.S., for example, coupled with the numerous benefits provided by industrial robots and the advantages manufacturers are realizing in being closer to the production process, bode well for sustaining the increases we have seen in domestic manufacturing activity.