2012 State of the Industry: Welding

Forecast: Look for modest increases in oil and gas, agriculture, mining, railroad, transportation, defense as total system solutions get new talent up to speed as quickly as possible, focus on shorter ROI, and are customized by industry needs.

Posted: January 10, 2012

Forecast: Look for modest increases in oil and gas, agriculture, mining, railroad, transportation, defense as total system solutions get new talent up to speed as quickly as possible, focus on shorter ROI, and are customized by industry needs.

Mike Weller

Mike Weller

President, ITW Welding North America at Miller Electric Mfg. Co.

Manufacturer of MIG welders, TIG welders, stick welders, wire feeders, welding guns and accessories for widely diverse applications.

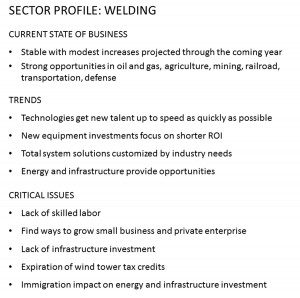

CURRENT STATE OF BUSINESS

I would say that the industry is stable and increasing. Energy related industries such as oil and gas remain strong and we are seeing demand for our products in all aspects of those industries, from capture to transmission and distribution.

Specifically in terms of global transmission pipeline construction, we’re seeing a shift to high strength steels that is requiring contractors to examine new technologies, processes and consumables. Heavy equipment manufacturing related to agriculture and mining is very strong, and between our welding automation business and advances in weld technology focused on process improvement and weld data monitoring, we’re seeing substantial growth there.

Rail, ship and defense are all experiencing significant growth rates. In shipbuilding, specifically, we’re seeing a focus on building with lighter, high-strength materials, which also requires a bit of adjustment in weld practices. For that industry we have responded with new advanced aluminum systems, and new welding technologies that focus on point-of-use controls that allow welders to substantially increase their productivity.

We are working with all of our sister companies to identify the challenges each of these unique industries are experiencing and to create optimal solutions to address that growth. That will be a major focus for all of our sister companies moving forward: total system solutions designed to answer the specific pains of each of these individual markets.

MAJOR TRENDS

As a customer-driven business, our solutions are built entirely on what our customers are asking for and what they will need in the future based on industry trends. Based on what we know today, our customers are willing to invest in their businesses to address productivity, quality and cost reduction issues and we have industry-specific solutions that address each of those demands.

Businesses are cautious in the current climate when it comes to capital expenditures, but to remain competitive, there is improvement and expansion that needs to occur, and we are seeing that happen across most of our key markets. A few key trends:

Labor shortage: This is nothing new in the welding industry, and as a manufacturer and industry advocate we’re doing everything in our power to provide technologies that help simplify training and get new talent up to speed as quickly as possible in production environments without sacrificing quality. We’re also partnering with tech schools to spur welding education and to improve interest in the industry so that we can start filling these skilled positions.

Equipment expenditures: As the economy took a hit, companies did not buy as much equipment as they would have typically and they have gotten a few extra years out of equipment they may have otherwise replaced. It’s getting to a point now where companies are in a position where they need to replace that equipment, but they need to do so intelligently. They know it’s not a matter of just swapping out what they had with a similar machine. People are taking the time to really examine what will fit best in their operation, and are seeing that much of the newer technology offers extreme benefits in terms of energy efficiency, space savings, and advanced processes and controls that are simple to use. The bottom line is how do we get more return on investment out of that footprint?

Total system solutions: It is very rare that one industry has the same welding demands as another and, as such, a great deal of our development is going into creating specific solutions geared towards specific industries. We’re taking a bottom-up approach, incorporating power sources, filler metals, consumables and accessories, and these solutions are being well received by our customers because they are tailor-fit to meet their needs.

CRITICAL ISSUES

Labor will continue to be a challenge, and we must work to inspire young men and women to see that this is a great industry with a great amount of opportunity and growth. There is also a great amount of pride and respect one can achieve in this industry while making an excellent living for them and their family. We can highlight this through increasing industry awareness, and by working with high schools and vocational schools to draw in talent to the industry at a much younger age.

We need to find ways to encourage the growth of small businesses and private enterprise. Their growth and success will not only enhance our growth and success, but it will strengthen the backbone of the nation’s economy. Finding new ways to spur private industry and to encourage entrepreneurs to build businesses that employ people and inspire growth should be one of our top legislative priorities.

Our greatest concern with policy is how it affects our customers: depreciation of equipment that they buy; the incentives they have to hire people; could reimbursements for training or other incentives be offered? A vast majority of opportunity in America today lies with small business – what is policy doing today to help small businesses, whether it is startups, or those who are getting back on their feet in the economy?

Investing in infrastructure is also vitally important. Admittedly, we have an interest there because our products are used extensively in infrastructure, but it is also sorely needed in every corner of this country. With new infrastructure comes jobs and demand for equipment and services, and a corresponding increase in manufacturing and innovation. Continuing to modernize our nation’s infrastructure is good for everyone.

PERSONAL INSIGHTS

We believe that strength at home leads to strength globally. For that reason, we wholeheartedly support efforts such as the Association of Equipment Manufacturers (AEM) “I Make America” program that are dedicated to growing American manufacturing jobs. The playing field continues to level, and people around the globe are starting to see the value and strength of American manufacturing.

Miller Electric Manufacturing Co., 1635 W. Spencer Street, PO Box 1079, Appleton, WI 54912-1079, 920-734-9821, www.millerwelds.com.

Andrew Masterman

Andrew Masterman

President and CEO, ESAB North America

Manufacturer of plasma cutters, welding equipment, automated systems, consumables and welding filler metals for virtually every welding and cutting process and application.

CURRENT STATE OF BUSINESS

We see steady, modest growth for 2012 and do not believe we will see strong growth – certainly not to the levels we saw in 2011 – but the growth will be stable across several different industries. Past the coming year becomes difficult to predict, but we are comfortable with a steady, modest growth pattern for the upcoming year.

MAJOR TRENDS

We see several trends that will directly impact our industry. Population growth is a major driver for increases in energy and infrastructure investment. Population growth in the U.S. due to birth rates and immigration is creating a very real need for more infrastructure and more energy. The increased demand in these two areas directly involves the welding industry in the areas of bridge construction, oil platforms, nuclear facilities, and alternative energy generation.

CRITICAL ISSUES

Several issues are relevant to our industry. One of the most critical issues is the expiration of wind tower tax credits at the end of 2012. Every energy segment has tax advantages that are designed to stimulate growth in energy production. These wind tower tax credits allow wind tower builders to construct towers affordably. If these tax credits are allowed to expire, I believe we will see a dramatic drop in orders in the second half of 2012, with orders in 2013 being minimal.

Another critical issue is immigration. Regardless of the various opinions about immigration legislation, immigration does fuel population growth. Countries that take a highly restrictive approach to immigration tend to see less economic growth because population growth requires additional investment in infrastructure and energy – two industries that are directly tied to the welding industry.

We are continuing to invest in several key areas in the North American market. We are expanding our domestic production capacity and launching new products. We see continued growth in processes that use MIG wire, and we are also investing in submerged arc welding products and technologies. We recently opened an automation process center to meet our customers’ needs in terms of training, development of customized solutions, and ongoing support in welding automation.Another new facility will expand our domestic production, bringing products that were previously manufactured outside the U.S. back into this country. Domestic production allows us to meet demand in the North American market more quickly and efficiently.

PERSONAL INSIGHTS

We are optimistic about the trends we see for 2012. Macroeconomic indicators and discussions with our customers seem to indicate a continuing growth trend in the North American market. We have launched several successful new products that are driving sales for related consumables. We see continued growth in certain product lines and stick electrodes. Our new AC/DC inverter and Swift Arc Transfer and Integrated Cold Electrode technologies are receiving very positive market support, and we expect that to continue.

While we believe growth in 2012 will be modest, we are comfortable that it will be steady and stable – that’s why we are investing in the North American market.

ESAB North America, PO Box 100545, 411 South Ebenezer Road, Florence, SC 29501, 843-669-4411, Fax: 843-664-4258, www.esabna.com.