The State Of Manufacturing: A Positive Outlook

Slowing global growth, domestic fiscal uncertainties, higher taxes, and other persistent headwinds in the economy have spurred weaknesses in the manufacturing sector. However, with the recent uptick in activity, Dr. Chad Moutray of NAM explains why there is reason to be positive about the outlook for an ongoing manufacturing renaissance in the U.S..

Posted: January 7, 2014

Construction and manufacturing were two of the hardest hit sectors in the Great Recession, accounting for approximately half of total job losses in 2008 and 2009. Manufacturing alone lost 2.3 million jobs during those two years, but we have added back roughly 500,000 since then.

In 2010 and 2011, manufacturing accounted for 10.4 percent of all net new jobs that were created in the economy, leading the U.S. out of the recession. Despite the initial surge in job growth, the manufacturing sector has underperformed over the past twelve to fifteen months in terms of output, exports, and continued employment growth due to additional stumbling blocks.

Slowing global growth, domestic fiscal uncertainties, higher taxes, and other persistent headwinds in the economy have spurred weaknesses in the manufacturing sector. However, with the recent uptick in activity, there is reason to be positive about the outlook for an ongoing Manufacturing Renaissance in the U.S.

Chad Moutray and Kemp Harr, the publisher of Floor Focus Magazine, discuss NAM’s economic outlook. Chad also addresses the economic factors that are motivating companies to bring their manufacturing back to the U.S.

CURRENT MANUFACTURING TRENDS IN THE U.S.

(1) Recent Sector Underperformance: In terms of output, exports, and employment, the manufacturing sector has underperformed over the past twelve to fifteen months.

(2) Forecast for Future Growth: The good news is that activity in the manufacturing sector is picking up, with leaders cautiously optimistic about future growth.

(3) Positive Economic Indicators: Some positives in the economy overall include consumer spending, the ongoing housing recovery, low inflation, increased energy production, and productivity gains.

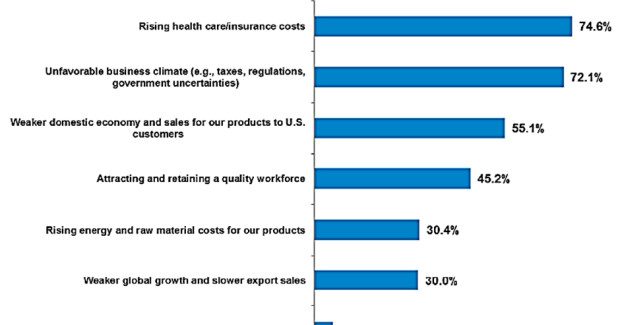

(4) Regulatory Policies Contribute to Uncertainty: Regulatory policies are a huge source of uncertainty for the manufacturing sector, with manufacturers worried about the long-term economy.

MANUFACTURING TREND ONE: RECENT MANUFACTURING SECTOR UNDERPERFORMANCE

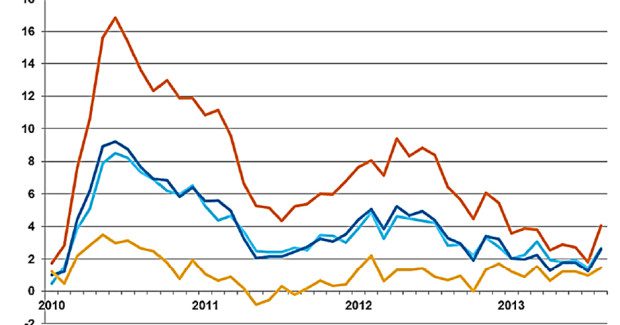

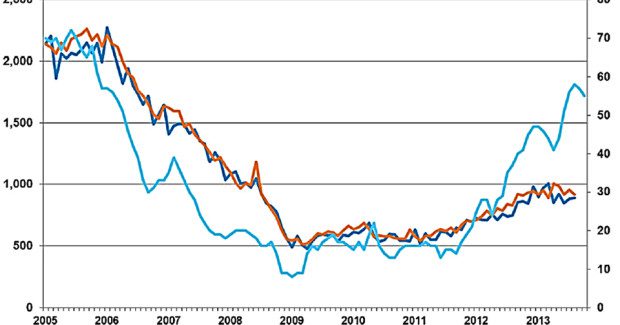

Industrial production has been up and down over the past eighteen months; the U.S. has been unable to sustain traction in terms of overall manufacturing production. Between November 2012 and February 2013, economic indicators were positive; however, in March, manufacturing production fell off. More recently, there was another decline in July followed by an uptick in August. Overall, industrial production has decelerated significantly.

The year-over-year industrial production growth rate in July was roughly 1.3 percent. Ideally, that figure should be 4 percent or more. What is driving these low growth numbers? A large part is a result of domestic challenges — the fiscal cliff, sequestration, higher payroll taxes, higher marginal tax rates, and government uncertainty.

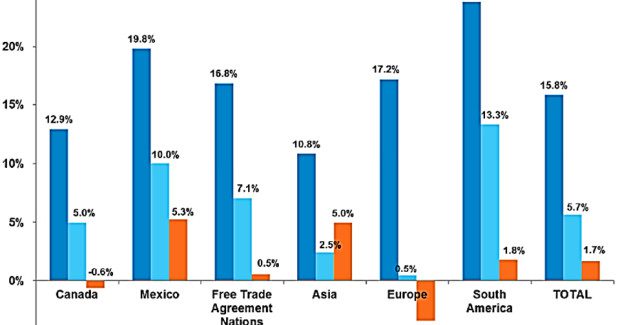

Looking globally, exports of manufactured goods have been positive this year, but just barely. This too has been a disappointment. Specifically, there has been only 1.7 percent growth in exports of manufactured goods this year.

To put this into perspective, the Administration has a stated goal of doubling exports by 2015, yet the U.S. is only halfway toward meeting that goal. It’s important to note that the export target was set at the end of the recession — initial growth numbers appeared promising due to momentum in the first couple of years as we rebounded from the trough. Now, there is cause for concern. It will be a challenge for the U.S. to make up the difference in the second half of this period given the current performance.

The most significant drag on the overall U.S. numbers has been exports to Europe. Europe remains the second-largest trading partner for the U.S. As Europe recovers, the numbers are improving, but they are still negative. Exports to Europe are pulling down the overall export growth rate, and consequently, industrial production growth in the U.S. It is not the only factor impacting export growth. Exports to Canada, the largest U.S. trading partner, declined slightly during the first six months of 2013.

Although exports have reversed their negative trend in July and manufacturing employment also continues to be comparatively weak. Employers remain hesitant to bring new workers on board given the current climate of uncertainty and dampened domestic and global demand. Employment numbers have been hurt by a sharp decline in hiring, and since February, manufacturers have actually shed 25,000 workers. Despite these negative trends, there are reasons to be optimistic looking ahead to the next several years.

MANUFACTURING TREND TWO: FORECAST FOR FUTURE GROWTH

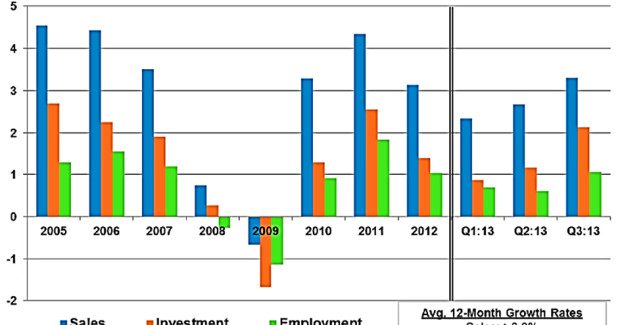

Despite the softness in production and job growth, there has been an upward trend in activity in several areas— manufacturing sales, investment, and capital spending to name a few — which influences sentiments in the sector.

The NAM/IndustryWeek Survey of Manufacturers closely tracks these trends. The percentage of respondents with a positive business outlook increased to 76 percent in the latest survey, taken in September 2013. This is a rebound from the low of 52 percent at the end of 2012 following the election and just before the fiscal cliff deal was negotiated. Although below the high of 89 percent in March of 2012, the mood is currently trending in the right direction.

This increased positive outlook was also reflected in expectations for future sales, investment, and employment. Sales are expected to grow 3.3 percent over the next twelve months, the fastest pace seen in the past five quarters. However, there is a significant difference between large manufacturers (more than five hundred employees) and small manufacturers (fewer than 50 employees).

The large manufacturers are displaying more optimism and projecting much larger increases in sales growth, investment, and job growth than their smaller peers. Similarly, manufacturers with higher expectations of export growth tend to have a better economic outlook. Although the survey suggests that overall manufacturing employment will experience modest gains, 60 percent of all respondents reported that they plan to keep their employment levels unchanged.

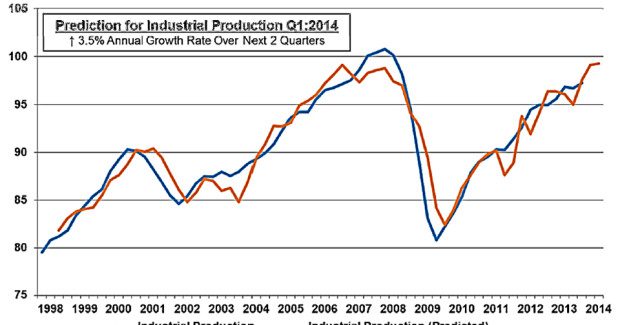

The NAM has developed a model that predicts industrial production based upon the survey data and other variables including housing permits, the interest rate spread, real personal consumption, and the S&P 500. There is a strong correlation between the model’s past predictions of industrial production growth and actual results.

The results of the current survey indicate that overall industrial production should accelerate over the next two quarters, possibly at a 3.5 percent year-over-year rate. That would suggest an increase from the slower pace over the past year and half — definitely good news if it comes to pass.