A Strong Outlook Ahead

State of the Industry: Manufacturing is seeing rapid, exciting change in ways never before imagined – and it’s just the beginning for what’s to come.

Posted: December 22, 2014

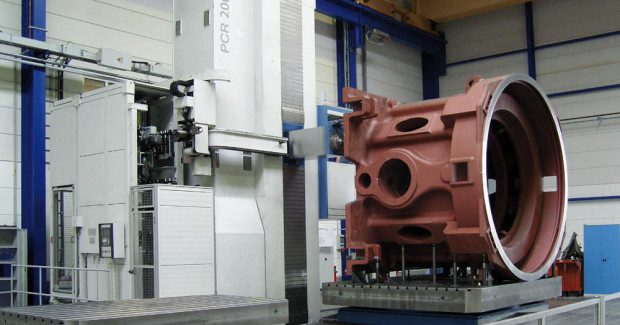

THE CURRENT STATE OF BUSINESS

Overall, the U.S. manufacturing technology market continues to be very strong. In the fifth year of recovery from the 2008-09 recession, the industry continues to grow and build strength. Strong market conditions in the automotive, aerospace, energy, and medical industries are leading to manufacturers continuously looking for ways to improve productivity, and they are making investments in the newest technologies to help them meet their goals. Additionally, the average age of capital equipment installed at U.S. manufacturing facilities is now 22 years, meaning there is an aggressive push to invest in newer technologies in order to meet demand.

Many other factors are playing into the market’s strengths. Interest rates and energy costs continue to remain low and labor costs are stable. As a result of those factors, in addition to a desire to shorten supply chains and produce goods closer to end users, foreign direct investment in the United States continues to grow. U.S. foreign direct investment stood at $230 billion in 2013 according to the Bureau of Economic Analysis, with $94 billion tied to manufacturing.

Economically, the Institute of Supply Management’s Purchasing Managers Index (PMI) has shown 18 consecutive months of expansion (readings above 5 0) through this past November. Additionally, capacity utilization in U.S. manufacturing has consistently stayed above 77 percent throughout 2014 – an indication that businesses have a need to invest in new manufacturing equipment to keep pace with demand.

In terms of export potential, U.S. manufacturers are as focused as ever on expanding into international markets. The United States creates the world’s most innovative technology, which is highly sought after in the high-growth international markets for manufacturing. We continue to be a driver in technology for advanced manufacturing processes with automation, additive manufacturing, advanced materials, and sensor-based technology that allows for more use of Big Data in manufacturing and a connected shop floor, aka the Internet of Things.

MAJOR TRENDS

We cannot possibly underestimate the role of Big Data in every aspect of today’s manufacturing operations. From keeping track of sales and customer data, to employing real-time information for parts and other inventory, to monitoring and analyzing production data straight from the shop floor, data is the means for driving seamless operations and optimum productivity.

Our trade association continues to be on the forefront of helping our members leverage the data that is available to them at an exponentially growing rate. In 2006, we funded the initial development of MTConnect, an open-source communications and interconnectivity standard for manufacturing equipment and devices. This platform gives data a “common language” that can be shared and extracted, allowing for monitoring and analysis of things like equipment performance, energy use, operating conditions, and a number of other metrics. It also allows for remote monitoring from any location. This type of standard is the very foundation for the “smart factory” of the future – a connected shop floor where data is seamless and easily accessible.

Since its initial development, MTConnect has grown in prominence throughout the industry and has some noteworthy users and proponents, including Mazak, GE, and the Department of Defense. Earlier this year we partnered with the National Center for Defense Manufacturing and Machining for the MTConnect Challenge 2, which awarded a total of $225,000 in cash prizes for MTConnect application development. The first place winner, Valerie Pezzullo, was an engineering graduate student at Clemson University who developed an application to detect chatter in the machining process, and she worked with Okuma, one of our member companies, in developing it.

So beyond MTConnect being a great benefit to developing smarter factories and improving the entire manufacturing process, it also allows for near-limitless possibilities in developing new ways to deploy it. In this case, it brought together academia, business, and government to create a solution to a common issue in manufacturing. This is just one example of the possibilities offered by digital manufacturing!

CRITICAL ISSUES

The shortage of skilled labor is an ongoing issue for manufacturing. As Baby Boomers retire from the workforce, they are leaving behind a talent gap that simply is not being filled at an adequate rate. Unfortunately, manufacturing has faced a perception problem among the general public in terms of its suitability as a career. While many adults say that they believe manufacturing is a great source of well-paying careers, a number of them also say they would not encourage their children to pursue work in the industry. Part of our role is to spread the word that not only does manufacturing offer good opportunities for growth, it is also an advanced and high-tech industry that requires a lot of smarts and know-how.

There are a lot of encouraging developments in developing a 21st century Smartforce. These days, many manufacturers are partnering with local community colleges and technical schools to develop a curriculum appropriate to addressing their workforce needs. Companies are also developing their own training programs for their own employees as well as their customers.

At the IMTS 2014 event held in Atlanta, we hosted our largest-ever student event, the Smartforce Student Summit at IMTS 2014. Students, educators and parents came to McCormick Place to get a first-hand look at advanced manufacturing technology, learn about industry careers and the necessary education and skills to pursue them. The sheer number of attendees – students from 450 schools and dozens of scout troops representing 34 states – shows that there is a genuine interest in manufacturing careers, and I think we can take that as a good sign for the future. But we must continue to look for partnerships between industry and educators to keep the momentum going.

Beyond skilled labor issues, we also continue to see challenges for U.S. manufacturing in terms of tax issues, regulation, and trade. Tax reform is vital. While our competitors in the developed world have made significant strides in lowering tax rates, the U.S. has done little to alleviate the tax burden on American businesses. In fact, it’s done the opposite. The haphazard way our tax policy is legislated and applied continues to be a lag on investment and hiring – a hindrance to meaningful economic recovery.

What is on our wish list? Ultimately, taxpayers need a simpler system that lowers rates for most individuals and corporations. On the business side, any overhaul of the tax code should include moving to a territorial system of taxation, like most of our trading partners. Our capital cost recovery system should also be updated to reflect the rapid pace of manufacturing technology innovation, with the goal toward full expensing of capital equipment. In the short term, Congress should improve and make permanent the R&D tax credit and the 2013 Sec. 179 expensing levels. This needs to be addressed with a permanent solution, not just continuing with temporary extensions that only compound economic uncertainty for manufacturing businesses.

Additionally, manufacturers need a sound and predictable regulatory system that improves the working environment for businesses and employees. The process for promulgating regulations should be uniform across agencies, transparent to include all stakeholders, and based on cost/benefit analysis and measurable results.

The global market for manufactured goods is worth $11 trillion, and the vast majority of the consumers live outside the United States. Trade agreements help build a fair and open trade environment that benefits American companies and workers. We need agreements that open our markets and reduce barriers to trade.

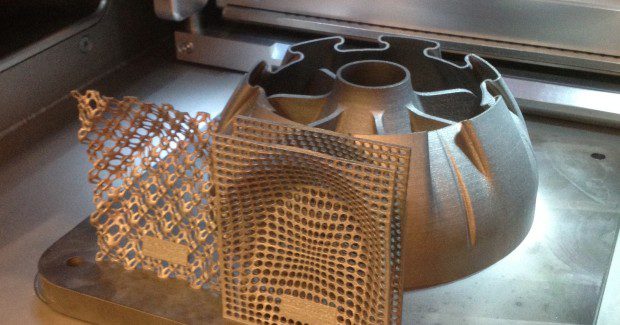

THE MAKER MOVEMENT

We love all the excitement we’re seeing around manufacturing. The realm of possibilities offered by additive manufacturing has created a great buzz and generated interest among young people. The “maker movement” has created a culture where people are learning how to imagine, engineer, and create things with their own hands. All of this is good for building on American ingenuity, innovation, and our entrepreneurial spirit. Likewise, the culture of manufacturing itself is changing. It’s becoming leaner, more agile, and more responsive.

The world of digital manufacturing is bringing in Silicon Valley-type knowledge to the world of making, a whole new world that brings data and other information technology onto the shop floor. Even MBAs are getting into the game! Finding a crowded field in such industries as finance and consulting, more MBAs are turning to careers in areas such as logistics, purchasing, and production management.

Manufacturing is seeing rapid, exciting change in ways never before imagined – and it’s just the beginning for what’s to come. I think 2015 is going to keep us moving forward on a solid path!