Domestic Aluminum Extrusion Shipments Increase

Aluminum extrusions in the U.S. and Canada, including imports, increased by 7.6 percent to 4.90 billion lb last year.

Posted: June 15, 2015

The Aluminum Extruders Council (AEC; Wauconda, IL) and the Aluminum Association (Arlington, VA) have released a industry estimates of aluminum extrusion shipments in North America by major market for last year. Among key findings, domestic consumption of aluminum extrusions in the United States and Canada, which includes imports, totaled an estimated 4.90 billion lb in 2014, an increase of 7.6 percent over the revised 2013 total of 4.55 billion lb.

This is the fifth year in a row that shipments of extrusions have grown and reflects a nearly 44 percent increase in annual shipments compared to 2009. Aluminum extrusions, in which heated aluminum is pushed through a hydraulic press fitted with a die that results in a linear profile that is further processed into end products, are the third-largest product segment in the domestic aluminum industry, representing about 18 percent of the total market.

The AEC and the Aluminum Association have collaborated on reporting annual end use figures for extrusions since 1999, resulting in a more accurate and up-to-date account of the North American aluminum extrusion industry.

“Aluminum extruders and AEC are grateful for the steady recovery we have seen the past five years,” said AEC president Rand Baldwin, “The outlook for future growth is encouraging. It goes to show that, when markets are fair and competitive, North American manufacturers, aluminum extruders in particular, can compete and win.”

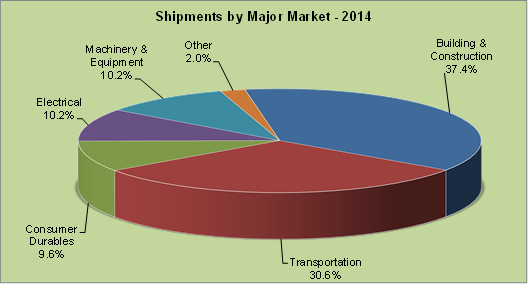

Building and Construction continues to be the largest market segment in the extrusion sector with domestic shipments of 1.83 billion lb, or 37.4 percent of the domestic market for extrusions. In 2014, shipments in this market segment grew 8.3 percent compared to the previous year. Doors and windows, representing 31.9 percent of this market segment’s total shipments, grew 10.4 percent over 2013. At 31.7 percent of the Building and Construction market segment in 2014, shipments to curtain wall, store fronts, and entrances increased by 9.0 percent over 2013.

Transportation is the second largest market segment, totaling 1.50 billion lb in 2014 and representing 30.6 percent of total domestic shipments. In total, shipments to transportation end uses increased by 10.8 percent over 2013. Passenger cars, trucks, and buses accounted for 42.8 percent of shipments within this segment in 2014, followed by trailers and semi-trailers at 28.8 percent.

“The transportation sector has shown quite a big increase in shipments in 2014. We are seeing the results of U.S. carmakers striving to lightweight their vehicles based on cosumer demand for more fuel efficient vehicles as well as the government-mandated 54.5 mpg Corporate Average Fuel Economy (CAFE) by 2025, and extrusions are playing a bigger role in vehicle lightweighting,” noted Baldwin. “Truck trailer shipments have been robust as well, and that market is currently one of the strongest for the extrusion industry.”

Other market sectors include consumer durables (9.6 percent), machinery and equipment (10.2 percent), electrical (10.2 percent), and other end uses (2.0 percent). While not for domestic consumption, U.S. and Canadian producers also exported 287 million lb of aluminum extrusions in 2014, representing 5.4 percent of total industry shipments.

The groups note that some of the historical data included in the “End Use Shipments of Aluminum Extruded Products” report has been revised in this most recent release. The revision, a collaborative effort by billet suppliers and domestic extruders, includes adjustments to figures on shipments and end use markets for the 2001 to 2013 period.

Based on the Aluminum Association’s most recent annual survey on shipments of extrusion billet, members from both groups conclude that previous estimates on the size of the domestic aluminum extrusion market had been understated. Adjustments have been made to account for this understatement and should more accurately reflect actual activity in the market during this period. Details on shipments and end uses for 1967 to 2014 will be made available in the Aluminum Association’s annual factbook, the Aluminum Statistical Review for 2014, which is scheduled for release in the third quarter of this year.

The Aluminum Association continually strives to improve its domestic market estimates and will continue utilizing the annual billet survey, along with existing surveys (their monthly shipments survey and quarterly end use survey, and the AEC annual end use survey), to benchmark shipments to major markets and specific end uses. Both groups encourage additional companies to participate in the monthly, quarterly and annual surveys, so that the data better capture emerging trends and more accurately reflect current market realities.

Statistics are based on the results of surveys conducted by the Aluminum Association in cooperation with the AEC, as well as estimates developed by the Aluminum Association’s Statistical and Market Research Committee. The surveys compute and summarize changes within each specific market segment.

The Aluminum Association monthly and quarterly surveys represent about 57 percent of industry shipments. The AEC annual end use survey for 2014 compiled data from 51 participants and these participants represent approximately 71 percent of total industry shipments. The contributions by these 51 participants are an important component of our process to develop end use estimates for the industry.

An aluminum extrusion is produced by pushing heated metal through a press to produce a desired form or shape. Typical applications for extruded products include window and door frames, store fronts, auto body frames, solar panel mounting systems, and heating, ventilation and air conditioning (HVAC).