Analytics: The New Frontier in Manufacturing

Data analytics is a key technology that is creating new frontier for manufacturers to uncover new insights that can speed their decision-making and improve their business performance.

Posted: July 31, 2015

With all of the talk about leveraging the “right” smaller data sets, as well as the opportunity to leverage the explosion of Big Data being created by the emergence of the Internet of Things (IoT) in manufacturing, it is interesting to see where the realistic state of the industry is in regards to the use of data analytics. It appears to be a forgone conclusion that data analytics is a key technology that is creating a new frontier for uncovering new insights that can speed decision-making and improve manufacturing business performance. However, the application of advanced analytics technologies is not without its challenges, including:

- What are the top strategic objectives and challenges of manufacturers and how do these relate to the potential use of analytics?

- What is the state of manufacturing in regards to the use of the latest analytics techniques to improve operational and business performance?

- What are or what will be some of the key application areas and users of analytics for manufacturing?

- What are the key technology trends and issues associated with analytics?

- Where are some of the challenges in applying analytics today by manufacturers?

- What steps should my company take to take advantage of analytics?

TOP STRATEGIC OBJECTIVES FOR MANUFACTURERS TODAY

Our 2013-2014 Manufacturing Operations Management (MOM) survey examined inputs from over 550 manufacturing business professionals across a broad range of industries. As part of this research, we explored their top strategic objectives and operational challenges, along with how innovative new approaches to this complex landscape of challenges are being addressed in order to provide unprecedented new gains in agility, productivity, quality, responsiveness, risk mitigation, and economic value generation. In addition to this research, we gained further insights from our “Metrics That Really Matter” joint research project with MESA International of over 350 professionals on manufacturing metrics.

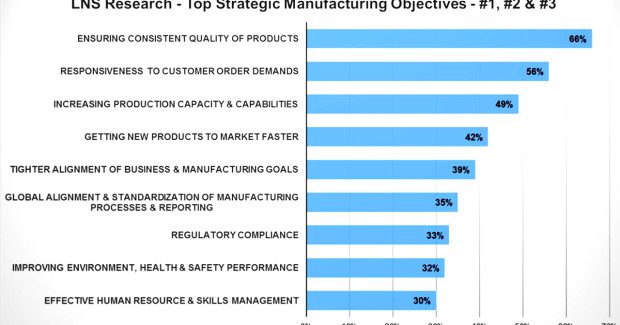

Our MOM survey uncovered the Top One, Two, and Three Strategic Manufacturing Objectives of manufacturers across a broad range of industries: 37 percent were from discrete manufacturing industries, 17 percent from process manufacturing, 15 percent from food and beverage/consumer packaged goods, 12 percent from life sciences, and 19 percent from all other industries. It was refreshing to see how all of the top objectives related to serving customers. First and foremost, 66 percent of manufacturers focused on ensuring consistent product quality, followed by 56 percent that focused on ensuring timely order fulfillment/responsiveness to customer demand. These areas of customer focus bode well for all of manufacturing, because if customers are not being properly served and satisfied, then ultimately nothing else will matter for a manufacturing business. When we look at the Top One, Two, and Three associated challenges that manufacturers face in meeting these top strategic objectives, we find multiple simultaneous challenges that must be addressed.

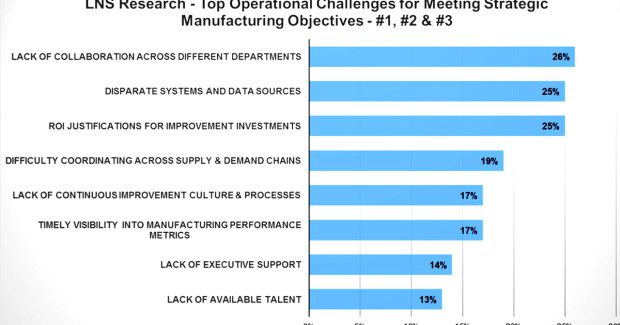

The top operational challenge is how to break down silos of organizations and departments and foster greater collaboration. To a large degree, this is a leadership issue and a failure point that we find in the Operational Excellence journeys of many organizations. Manufacturers that effectively address this challenge are in a much better position to be agile in their responses to customers, to deliver superior products and services, and to be more efficient in doing so. Having multiple departments share some of the same goals and objectives, and being on the same page with the same data, information and key performance indicators (KPIs) is another best practice that can help address this challenge. Basic data analytics technologies can be utilized to create these KPIs in a consistent and timely fashion.

The next highest operational challenge that manufacturers have is getting the required data and information out of the many disparate systems and databases that exist across their plants and enterprise. Manufacturers are looking to do this in order to support and sustain their process improvements. The ability to connect, federate, aggregate, analyze and contextualize data from multiple sources into useful and timely information is a key capability of today’s available manufacturing software solutions, such as Enterprise Manufacturing Intelligence (EMI). This is another application that is ripe for better and easier-to-use analytics.

The third highest challenge that many manufacturers struggle with is creating ROI justifications for improvement investments. Benchmarking and researching what others have done in similar circumstances can help with understanding the range of potential ROI. Putting an effective metrics program in place that includes baseline measures and real-time performance management is also critical to proving ROI. More evidence of how analytics can play an important role in effective real-time performance management is needed, and we will discuss this in a moment.

MATURITY OF ANALYTICS SOFTWARE USE FOR MANUFACTURERS

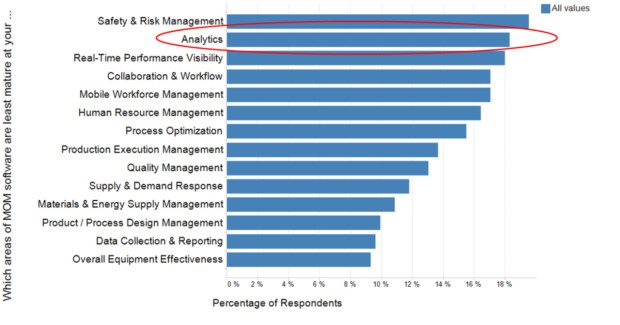

When asked which areas of MOM software were least mature in their organizations, Analytics was the second top response, just behind Safety & Risk Management software. This indicates that there is a long way to go before manufacturers get the most out of the potential that analytics technologies has to offer. Other software application areas that are fairly mature in comparison include Overall Equipment Effectiveness (OEE), basic data collection and reporting, and software for the fundamental management of products, production, processes, materials, quality, etc. However, going forward all of these more mature areas of software applications will also benefit from the addition of better analytics.

The attitudes of manufacturers, in regards to the business criticality of analytics software, lies somewhere in the middle of their mindsets. When asked which MOM software applications are most critical to their business success, analytics came up right in the middle of the list, which indicates there is more to be understood and proven when it comes to using analytics within manufacturing operations. So what exactly are the trends surrounding the applications of analytics by manufacturers?

TRENDS IN MANUFACTURERS’ USE OF ANALYTICS FOR PERFORMANCE MANAGEMENT

More and more, manufacturers are looking for combinations of business and operational analytics — especially to better manage their performance metrics that drive financial improvements. This means having analytics that put operational information in business context is becoming an important requirement. The typical scope of operational metrics is expanding well beyond the assets and productions areas of a plant. For 23 percent of manufacturers, business unit level operational metrics are being measured and compared. And 35 percent are doing this as a corporate/enterprise scope of activities.

On a daily or even more frequent basis, 65 percent of manufacturing operations managers are engaging much more actively in both business and manufacturing metrics. More plant operators and supervisors are not only seeing process control trends and statistical reports, but also operational analytics and metrics in real-time — so they can visualize the financial impact of their actions. Along with these uses of analytics and metrics in manufacturing operations, real-time analytics are supporting the timeliness of information and decision making for these specific roles on the shop floor:

- Quality Managers are using simple pareto chart analytics to evaluate the effectiveness of quality processes/workflows, in addition to the product quality attributes. These managers are becoming more aware of the importance of end-to-end quality and the costs of good and poor quality by aggregating and analyzing quality results.

- Quality Engineers are using risk models to understand where product failures are likely to occur.

- Maintenance Personnel are primarily focused on asset availability (MTTR, MTBF), while many are using RCM techniques. However, they are also using specific analytics technologies to predict/avoid failures or performance degradations (e.g. vibration, corrosion analysis).

- Energy Directors are using analytics for real-time energy usage/cost optimization and tying energy use to asset performance and conditions.

- Safety Leaders are performing EHS modeling using process analytics for emissions/carbon reporting and Operational Risk modeling for “what if” analysis that is tied to real-time risk registers, hazards, assets and impacts.

When looking across the landscape of different analytics technologies being applied across manufacturing businesses, there have been a number of different classifications of core systems and software application solutions employed. These include:

- Physical Process Design Analysis (e.g. plant/process design and simulation)

- Product Design Analysis (e.g. PLM)

- Work Process/Business Process Analysis (e.g. BPM)

- Product Attributes Analysis & Traceability (e.g. MES, Track/Trace)

- Quality Management (e.g. SPC, Reliability)

- Performance Metrics Analysis & Generation (e.g. Data Historians, EMI, BI)

- General Purpose Analysis (e.g. Microsoft Excel)

Since many of these systems and applications are already in place and widely used, the databases and software basis for future analytics technologies is actually already in place for many manufacturers. However, some key new trends are occurring in relation to analytics:

- Analytic engines are moving to the cloud as well as to “edge computing” or embedded devices — so analytics are becoming more pervasive.

- Powerful new Platforms as a Service (PaaS) analytics processing engines are being applied to a wide range of business and line-of-business applications. Expect to see these easily scalable, cloud-based analytics engines being applied more and more in places where specialized analytics were utilized in the past. This is due to faster and less expensive computing techniques along with a growing awareness on how to more effectively harness large sets of unstructured data — Big Data.

- Technology providers are actively working on making advanced analytics ever easier to use by both sophisticated and casual users. These new-generation analytics will need to be a future requirement for manufacturing organizations to be successful.

- In general, we see three main classifications for analytics toolsets based on the sophistication/type of user: 1) tools for pre-preparing analytics for end-users by IT or engineering professionals, 2) tools that support self-service, ad-hoc analytics, and 3) more sophisticated tools for data analysts/designers/scientists.

- Today’s expectation is that analytics tools and information is delivered “on demand” and with exception notifications and alerts being automatically sent to the computing devices of choice, based on different classifications of users: 1) Web browser clients (general users), 2) mobile apps (general users and management), and 3) rich clients (especially for sophisticated users).

- Combinations of traditional and emerging IoT architectures will need to be supported with new generation analytics. This means a combination of existing databases and applications, as well as both small and Big Data, needs to be analyzed utilizing common tools that include combinations of embedded, edge-based and cloud-based computing and analytics.

- Lastly, many equipment, automation, and IT supplier companies are starting to use analytics as enabling engines behind selling performance, service levels and results, rather than just products. This business trend will accelerate in the future.

STEPS MANUFACTURERS SHOULD CONSIDER TO TAKE ADVANTAGE OF ANALYTICS TECHNOLOGIES

- If you are not already using analytics technologies to better understand your manufacturing business performance, get started with a solution that can address a subset of your most critical manufacturing metrics in support of continuous improvements.

- As a next step, look to expand the use of analytics to evaluate other areas of your production operations — such as quality, asset performance/maintenance, energy, safety, etc.

- As your organization becomes more comfortable relying on software and “purpose built” analytics to proactively manage your operations, look for ways to utilize more advanced analytics that can help you evaluate end-to-end production and business processes that include opportunities for optimizing the bigger picture of your supply and demand chain.

- Take the time with a small IT/engineering and operations team to evaluate some of the newer IoT and cloud-based, unstructured Big Data analytics tools, and how they may be readily applied to scale improve your manufacturing business.

- Look for suppliers with a proven track record of applying these newer IoT and cloud/Big Data analytics to solve manufacturing business problems.

- As part of your company’s future business models, consider utilizing analytics technologies and remote connections to provide additional value via new performance contracting or service opportunities.