Automotive Industry Reaches Cruising Altitude

The automotive industry has reached an inflection point and the entire manufacturing value chain will need to change the way it traditionally does business to remain profitable and be prepared for a future downturn. Here’s why.

Posted: March 2, 2016

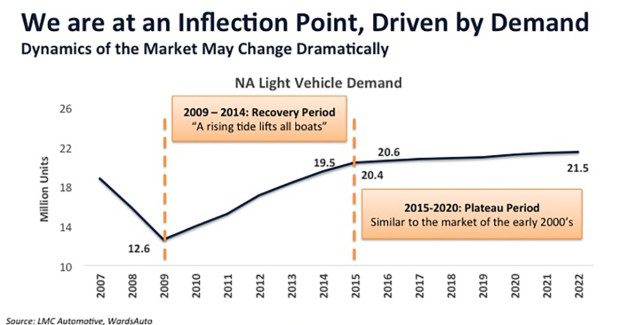

Since the recession of 2009, the global automotive industry has experienced a period of strong growth and profitability. Global light vehicle production reached 88.4 million units in 2015, and production in 2016 is predicted to reach more than 91 million units. However, looking to the future, the industry faces a number of key challenges, including the increased cost of manufacturing and the plateauing of product demand (see Figure 1). There are a number of market forces that impact the entire automotive supply chain: regulatory issues, customer demand, advanced technology and economic factors are all putting automaker profits at risk. Other factors that are eating away at profitability include increased complexity; high-mix, low-volume variants; increased capital investment; increased tooling costs; product development cost and timing; high launch costs and warranty costs.

The automotive industry has reached an inflection point and the entire manufacturing value chain will need to change the way it traditionally does business to remain profitable and be prepared for a future downturn.

MANAGING INCREASED COMPLEXITY

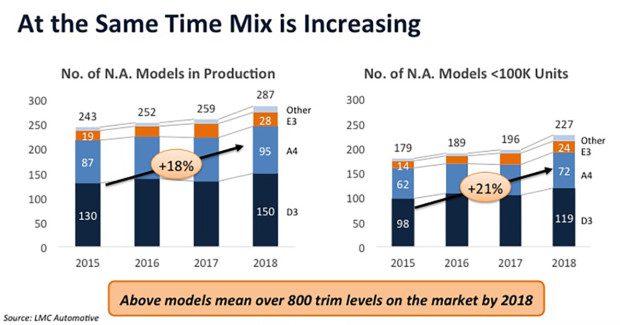

Increased complexity can be found across nearly all industries, including automotive. In North America from 2015 to 2018, the number of vehicle models in production is predicted to jump 18 percent, from 243 to 287. By 2018, 80 percent of the models on the market will be under 100,000 units of annual volume. This translates to more than 800 trim levels on the road by 2018 (see Figure 2). Additionally, vehicle designs are becoming much more complex and the materials utilized in production are shifting to lighter-weight alternatives. Some manufacturers are developing methods and strategies to assist in managing this complexity, while others are not. Companies that do not address this growing complexity face increased product development time and cost, increased tool cost due to the need for more tools, and higher launch costs – which is not sustainable in the long term.

Automakers will be looking for ways to squeeze cost out of the process, specifically among the lower tier suppliers. It will become increasingly important for suppliers to drive efficiency improvements and focus on the customers and programs that are profitable.

SKILLED TRADE GAP

The skilled trade gap is real, and it is and will continue to impact the automotive industry supply chain across the globe. In the U.S. the average age of a skilled worker is 56 years old, and the next generation workforce is not selecting skilled trades as a career. A recent survey by the Nuts, Bolts & Thingamajigs Foundation of the Fabricators and Manufacturers Association, International (Rockford, IL) indicates that 52 percent of teenagers have no interest in a manufacturing career, while 61 percent think manufacturing careers are dirty and dangerous. Additionally, another recent study by the Manufacturing Institute (Washington, DC) predicts that in the next decade nearly 3.5 million manufacturing jobs will likely need to be filled and, because of the skilled trade gap, nearly 2 million of those jobs will go unfilled.

The automotive industry will need to get creative and invest in attracting and educating its next generation workforce for continued growth.

THE GLOBAL INDUSTRY

Taking a closer look at the global automotive industry uncovers both positives and negatives, depending on the region. As a whole, the industry can expect new profit and growth to come from new and emerging markets. In North America, the automotive industry will see vehicle demand level off at 20 million units. However, due to a number of reasons new vehicle launches will reach unprecedented levels. In 2017, 2018 and 2019 the region will experience vehicle launches of 40, 49 and 39, respectively. It is likely that this increased cadence will put a strain on resources throughout the supply chain, including metal fabrication.

Mexico is experiencing a manufacturing boom in aerospace, electronics and automotive manufacturing. The country is in its infancy of the manufacturing revolution, but due to NAFTA and other free trade agreements the industry continues to grow. Labor rates continue to be low, with labor costs almost 20 percent lower than China, and its proximity to the U.S. creates a lower-cost logistics scenario. However, Mexico still faces a challenge of building a skilled workforce and managing the talent gap within the manufacturing industry. Turning to Canada, that nation is experiencing a favorable exchange rate that the manufacturing industry and mold builders or die manufacturers are profiting from. However, those mold builders or die manufacturers are hindered by the fact that most of the raw materials needed for manufacturing are purchased from the U.S., and their labor rate structure is higher in Canada than the U.S.

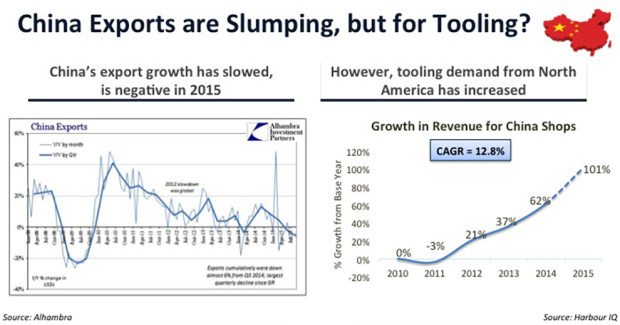

Moving overseas to China, since recording double-digit growth in 2010 the Chinese economy has significantly slowed and the world’s second-largest economy is expected to continue to deteriorate in the near-term. Chinese exports are significantly slowing, which indicates a decrease in the global economy leveraging the country as a low-cost resource (see Figure 3). Additionally, the slowdown in vehicle sales is likely to impact the bottom line of automakers around the globe. The European automotive industry is showing signs of recovery, with overall sales in 2015 up 9.3 percent over 2014. However, the industry is far from being healthy and continues to struggle with continuous instability, an unfavorable exchange rate, and increased competition from emerging markets.

The South American automotive industry continues to struggle after reaching an all-time high of 4.6 million units produced in 2013. In 2015, light vehicle sales in Brazil, Argentina and Venezuela decreased 25.6 percent, .4 percent, and 12.6 percent, respectively. Brazil, the region’s largest economy, is not expected to see improvements in 2016 and will likely continue to impact its neighboring countries.

THE SHAKEOUT FOR METAL FABRICATORS

So what does all this mean to metal fabricators in the automotive industry? As we look at all the external forces and internal characteristics of the industry, there are two clearly distinct categories: the Have’s and the Have Not’s. And what differentiates these two are how they are addressing their commitment to and investment in several key business factors, including people, equipment, data, process, finance, and strategy.

The Have’s are making an effort to improve efficiencies and optimize capacity by investing in technology and improved processes. Investment in new technology is driving improved throughput and increasing capability, which will be critical for businesses to remain competitive and maintain profitability. Additionally, some companies are identifying and incorporating new processes to help eliminate waste, reduce rework, and deliver overall shop floor improvements. Organizations are tracking internal metrics, reviewing them and utilizing them to make decisions to improve performance. For the Have’s, data is critical for optimizing the shop floor, driving profitability, and meeting the growing demand without increasing their footprint.

HOW TO REMAIN PROFITABLE

Now, more than ever, it is critical to work “on the business.” Companies can no longer afford to guess or rely on doing things the same way they were done in the past. They must determine where they sit between the Have’s and the Have Not’s and develop a near- and long-term strategy. They need to keep an eye on the global economy, as well as on the trends that are impacting the current customer base. Leadership must gather and review both internal and external data. Triangulation of customer information, industry knowledge/historical performance/experience, and external market intelligence are the cornerstones of developing a strategic plan that will transition the Have Not’s to Have’s and help the Have’s continue to experience prosperity.