Make the Most of a Tool’s Entire ‘Life’

Successful shops always look for ways to differentiate and innovate for competitive advantage. Cashing in on the entirety of a tool’s life with an advanced tool management system is perhaps the most effective way to do that right now.

Posted: December 21, 2016

Go with me for a minute. Think of a single tooling component’s trip through a shop in terms of a life: it’s conceived when it’s ordered from a supplier and born and finds its way to the tool crib; it grows up in the bin and finds its perfect mate when it’s assembled; it does good work on the job, cutting metal and eventually rides off into the sunset, aka the scrap bin.

RIP tool. You lived a good life.

All kidding aside, notice how little of the tool’s journey through the shop is spent actually cutting metal? As in life, one’s career is just one of many factors in a happy life. In this case, the actual time the tool is cutting accounts for a fraction of its impact on the shop. Acquisition, inventory management, assembly, travel across the floor, wear and dispensing of a tooling component, they all happen with a certain efficiency – or inefficiency – and have a value. Shops know how much of their purchasing budget goes to tooling, but few know how much value is gained or lost while it’s in the shop. This is where tool management systems (TMS) come in. Every company has a TMS of some sort, whether it’s the tool room manager’s chicken scratch on a printed excel sheet or wirelessly tracking components as they move across a shop and automatically managing inventory based on their usage.

Based on my travels, the chicken scratch method, or some slight variation of it, is far more common today. But things are changing. The rise of Smart Manufacturing, the Industrial Internet of Things (IIoT), Industry 4.0, whatever you like to call it, is exposing the immense savings available while the more connected floor is making them more accessible. It’s drawing a stark distinction between reactionary chicken scratch- and proactive hyper traceability-TMS. The risk of a reactionary system is finding out the value of the tool’s journey the hard way.

Consider the following scenarios. A job makes its way from engineering and planning to the tool room. They discover they don’t have a certain insert or have just enough to start, but not to finish, and the stock sits until the insert arrives. That’s wasted spindle time, perhaps delayed delivery – maybe even paychecks – because of a missing insert that costs a few bucks. The other side of that coin is ordering more cutters just because the bin looks low and not having a job in the pipeline that requires them. That’s cash burning a hole in the tool shelves.

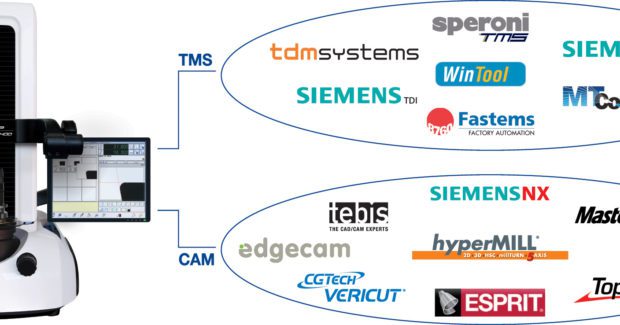

If you have an offline tool measuring system, you’ve already taken the first steps toward more efficient tool management. Sure, tool presetters reduce setup time and tooling costs by eliminating error and adding precision, but now they can also act as a shop communication hub. Our most sophisticated, and frankly most consistently successful customers, use Speroni tool presetters equipped with software called Edge Pro. Edge Pro communicates with the engineer’s CAM software, such as Vericut, to verify length, diameter, create a G-Code and post process with the exact tooling values. This type of arrangement is just scratching the surface. And believe it or not, suppliers have been working to get us to where we are for decades. Our Italian partner, Speroni, started working with Fiat automotive manufacturing more than 30 years ago, connecting tool rooms to the rest of the manufacturing facility.

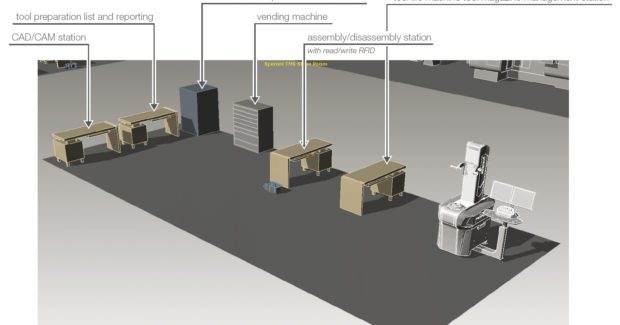

Today, most solutions are optimized for management, often without much flexibility to adapt to what’s happening on the floor or what may happen there next year. Having made our name in tooling – as far down in the weeds as you can get in a metalworking operation – we’ve worked with Speroni to apply a different philosophy to connectivity and traceability to our North American customers. Our solution, Intelligo, focuses on where everything is happening: the shop floor. Its processes are fed by using devices that recognize components, cutting edges, tool assembly, carts, baskets, etc. through wireless systems (i.e. RFID or QR/barcode) as they travel the shop.

At installation, we adapt Intelligo to the specific tool room, floor and systems. Using a scalable software structure and local workstations, Intelligo links a company’s entire tool library, active or inactive, with the CAM, planning and measuring software and displays it in a 3D graphic interface for visual reference in real time. This floor-up approach is not to say it’s incapable of capitalizing on Big Data (to use another buzzword) to inform management decision, far from it. Visibility and tracking of the floor’s activity allows a shop to proactively manage consumable inventory, consumption and assembly, preventing downtime and enhancing profitability.

You can monitor how tools wear on certain jobs and adjust. Or, if duplicate machines deliver different productivity on the same job, you can easily identify the exact tools used and find out what’s causing the discrepancy and diagnose machine or spindle issues. It’s even possible to determine a machine tool’s consumption in terms of discarded components following a particular production process. That’s not to mention the opportunity floor-up tracking and data provides to optimize tool regrinds, QA, raw material, fixturing – even the scrap bin, since it’s a profit center. This level of TMS may be a world away from how most manufacturers operate today, but for most it’s not that far out of reach. Installation is hands-on and cooperative, and most shops do have the fundamental infrastructure to support it.

This train isn’t stopping. The technology is here, readily available and quickly making excuses like “it costs money and doesn’t make chips” or “this is the way we’ve always done it” obsolete. Shop and process connectivity is the direction metalworking is headed and I believe a floor-up approach is the best approach.

Now is the most profitable time to get on board, before everyone else is. Successful shops are always looking for ways to differentiate and innovate, and cashing in on the entirety of a tool’s life with advanced TMS is perhaps the most effective way to do that right now.