The Future of Metal Trading is Digital

E-Shops, Marketplaces, Trading Systems: The fax and telephone era in the steel and metal trading business is coming to an end. The winners will be the traders who have been quick and purposeful in the digitization of their processes. This development will lead to fully automatic steel supply via the Internet of Things (IoT) – with or without steel traders.

Posted: April 14, 2018

Some outdated practices have survived in the steel community. The fax machine is one of them. While everyone nowadays has a smartphone and social media has been an accepted feature of everyday life for a long time now, modern communication in steel trading still revolves around landline phones and fax machines. The times are changing, however. “Digitization of steel trading has only reached the early stages of dynamic development,” says Dr. Heinz-Jürgen Büchner, the managing director of IKB Deutsche Industriebank (Frankfurt, Germany), who sees customers as the driving force. “As in other trading segments, the trend towards digitization is, in the final analysis, likely to be driven by the customers in this segment too.”

Many steel manufacturers are ahead of this. Offers to communicate with steel manufacturers digitally are already being accepted by many steel customers, as one industry expert recently made clear at an event organized by the German Association of Steel Distribution (BDS AG; Dusseldorf, Germany). Büchner’s conclusion: “In the short or long term, it will ultimately be necessary for steel traders to follow suit.” At the European level, more than one-third of steel sales is transacted via direct sales from the steel mill to the customer. In particular, large users in the automotive industry buy steel directly from the mill in the context of lengthy contracts. A further 37 percent is sold via steel service centers.

These companies, which specialize in services and machining, operate between classic material traders and manufacturing industries – frequently acting as the services division of steel traders, who lengthen their added value chain via machining, i.e. rolling, sawing, drilling, welding, thread cutting, bending or finishing of steel and aluminum. What the modest word “machining” involves extends as far as the production of complex components for the automotive, construction and machine manufacturing industries. “It is a striking fact that the percentage of direct deliveries by steel manufacturers is substantially larger with higher quality steel,” notes Büchner.

For example, more than half of coated flat steel products are supplied directly to the end-users by steel manufacturers. The customer-specific application and the need for more extensive explanation in sales transactions are apparently frequent reasons for this. Büchner concludes that this is both the risk and the opportunity for steel traders: “If the steel manufacturers can be matched via smart digital distribution channels, the loss of market share to them could be stopped.” He emphasizes that this is a challenge to steel traders: “However, failure to tackle this challenge will be punished.”

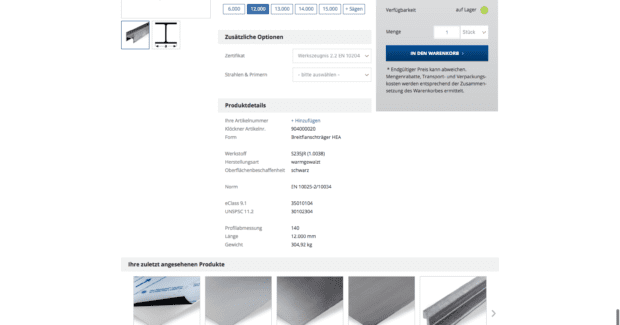

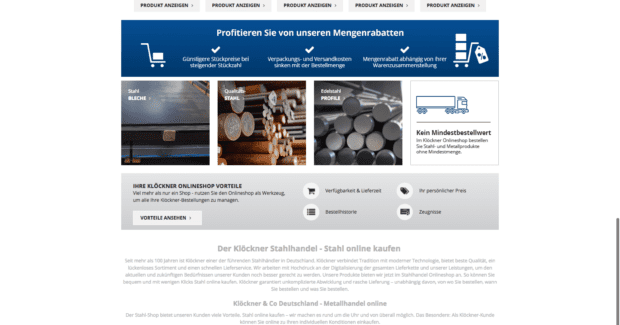

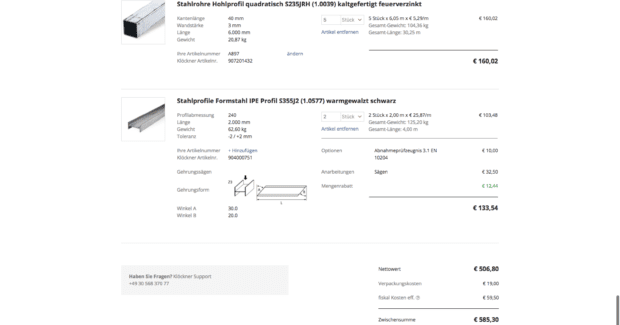

Gisbert Rühl is keen to avoid this punishment. Impressed by the success of the Amazon online marketplace and in search of new business ideas, the chief executive officer of steel trading company Klöckner & Co. (Duisburg, Germany) began by studying current ideas in Silicon Valley and then continued with an investigation of the start-up community in Berlin. Klöckner has a tradition that goes back more than 100 years and has been transformed into a digitization pioneer under Rühl’s leadership. Far away from the steel heartland in the Ruhr region, Rühl set up the creative laboratory kloeckner.i GmbH (Berlin, Germany) in 2014, which has been providing the corporate headquarters in Duisburg with fresh ideas from the trendy German capital since then. The steel trader went online with a new web shop in 2016, that includes a steel trading platform containing data about suppliers and customers. The aluminum business has been expanded at the same time.

Klöckner’s aim in digitizing steel and metal distribution is to initiate the end of the linear supply and performance chains that are typical of the industry. Reports state that steel and metal products will be traded in an increasing extent in the future via three digital channels: propriety online shops operated by individual traders; industry-specific vertical platforms; and cross-sector horizontal platforms. What Amazon is for Rühl is the online car marketplace Mobile.de for Ralf Niemeier, a managing partner of Montanstahl GmbH (Oelde, Germany) who aims to network steel traders and customers neutrally with his open trading platform steel.online that was established in 2015. Steel users can submit price inquiries about practically all kinds of steel products to this portal, where registered traders all over Germany can respond by submitting their quotations.

Predefined material categories, geometries and dimensions facilitate input and the search for online quotations. Estimation will be carried out fully and automatically in real-time in the future, where a designer will be able to upload his entire part list to the platform – with predefined lengths, dimensions and other general conditions – and make a national inquiry. Irrespective of the inquiry volume and complexity, he will then be able to receive his prices within seconds via dynamic automatic estimation modules, and place an order with a single click.

DISRUPTION OF THE OLD BUSINESS MODELS

For the steel trading business, which is bound by tradition, digitization is not simply a cultural upheaval; it represents disruption of existing business models. For decades, steel was bought in large quantities as inexpensively as possible and stored. If prices increased, traders sold with high margins. However, it is no longer possible to buy steel cheaply and sell it expensively at some time in the future because excess capacities of structural materials all over the world – particularly in China – are flooding the market and depressing prices. Temporary increases in steel prices are no help either in the long and medium term.

Klöckner supplies their approximately 130,000 customers in 12 countries to an increasingly digital extent. “We have increased the percentage of business accounted for by digital sales successively to 16 percent, most recently in the third quarter of 2017,” confirms Christian Prokopp, the director of kloeckner.i. “This corresponds to an annual volume of about one billion euros.” He reveals that Klöckner is observing a cross-sector trend towards online ordering, but ordering patterns differ according to the size of the customer. “Larger customers from the automotive or machine manufacturing industries like to place orders directly with us via EDI connections or via appropriate interfaces in their inventory control systems,” says Prokopp. “On the other hand, smaller building companies or craft businesses prefer our online shops. What is particularly interesting is that not only existing customers are ordering online to an increasing extent: thanks to our digital sales channels, we have already obtained a substantial number of new customers in a fiercely competitive market.”

The next steps are coming up in online business. “Now that we have already achieved very good success in the digitization of our sales channels and the internal processes, the focus now in 2018 is on expanding our available product range online,” explains Prokopp. “To this end, we are expanding our online shops into marketplaces by opening them up to complementary products from third parties.” He adds that Klöckner is, at the same time, establishing XOM – an entirely open industry platform independent from Klöckner and incorporating direct competitors.

MATERIAL EXPERTISE IS REQUIRED

The steel manufacturers themselves – companies like ArcelorMittal, thyssenkrupp and Salzgitter – have also recognized the opportunities offered by direct online trading, and they operate web shops of their own. Potential customers for them include roughly 36,500 small and medium-sized metalworking shops with 465,000 employees.

In traditional job bidding for fabrication work, a typical steel builder needs to find the next order almost as soon as they get back from the construction site. When bids are invited for a job, such as a warehouse or staircase for example, they must be familiar with the material costs. The normal procedure involves the steel builder submitting an inquiry to the trader via fax or phone, often including a request to be phoned back and then waiting around for a response. The builder usually receives an answer during normal business hours only, resulting in a number of days passing by before they can submit a binding offer for the job. But in an e-shop like the one operated by Salzgitter, materials needed for the job design in question can be compiled online, prices can be obtained immediately and estimates can be made.

This is the Amazon principle of buying conveniently online, whenever and wherever the customer wants – at home at half past two in the morning or on Sunday morning while on a skiing holiday. This model works in B2B business too. However, not all online material traders go as far as thyssenkrupp in this context: their new e-shop materials4me focuses not only on professional contractors, but also on ambitious DIY enthusiasts. In doing this, Germany’s biggest steel manufacturer is competing with such cross-sector platforms as Amazon, Alibaba and Google, all of which offer materials like steel and aluminum, albeit only a very limited selection of standard products without any major service.

Steel, however, is not a standard material: it is a structural material that can be put to many different uses and is available in Germany in about 2,000 flat steel or long versions. Steel products are alloyed, rolled and shaped in accordance with user requirements. Customers regularly expect steel mills to come up with new solutions to application problems, and steel manufacturers open up new markets for their customers by supplying innovative products. This sort of business requires intensive consultation, which makes steel trading and service operations very diverse.

OPPORTUNITIES FOR NEWCOMERS TO ONLINE TRADING

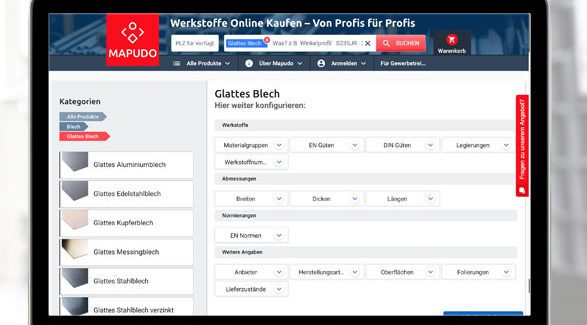

Whereas major steel traders like Klöckner or steel manufacturers like thyssenkrupp operate their own online shops, a shop of their own is often too complicated and too expensive for smaller traders. For customers, it is too time-consuming to have to search different shops in order to compare offers. Newcomers to online trading establish contact between as many traders as possible, including smaller ones and customers. “In general, there are surprisingly many successful entrepreneurs in the steel trading business who are open to change and are looking for new opportunities for pioneering activities,” states Stefan Grethe, a young entrepreneur who worked for thyssenkrupp steel trading operations before he established Mapudo GmbH (Düsseldorf, Germany) a start-up online marketplace for steel in 2014. “As project manager, I analyzed the customer and order portfolios of nine sales companies in Europe, the U.S. and Asia and discovered that the situation is the same all over the world, and there is considerable digitization potential in stock-holding steel trading.”

The response to Grethe’s answer from the steel industry varied: “Many found the approach very good, while others thought it came too early or rejected the concept categorically.” Even large market players, like the global steel pipe manufacturer Vallourec, are among the partners in the online marketplace for materials today. “It is very evident on the supplier side that steel and non-ferrous metal traders have become much more open to the idea of selling via online marketplaces,” reports Grethe. “Customers come from many different industries, from fitters to steel and metal builders, and from medium-sized industrial companies to large industrial maintenance groups. What they all have in common is that they need to quickly and simply procure materials in order to have more time for activities that add value.” He points out that developments in the second half of 2017 were particularly very encouraging, with total transaction volume higher than expected.

Further services like machining will be added in future. “Initial steps in this direction have been taken with mitre cutting and sheeting with customized dimensions, but a great deal must still be done,” notes Grethe, whose fundamental rule is: where we can create added value, we will develop new functions in liaison with suppliers and buyers.

Jürgen Wixler, the director of alloys2b GmbH (Munich, Germany), has modeled his operations on the way social media work. Alloys2b has focused on steel mills and foundries that need master alloys, alloys and non-alloyed material. “We started with a marketplace and very quickly developed into a software-as-a-service (SaaS) system,” explains Wixler. Alloys2b operates on the principles of a private tendering platform: buyers compile their own supplier pool with whom they trade, and the invitations to bid only go to these suppliers. Comparable to a friendship request on Facebook, customers can invite new suppliers by e-mail to test the first stage of future co-operation before expensive background checks are made. In this context, the system acts as a fast, digital communication channel between the participants.

“The special features of alloys2b are simple operation and product customization – an in-house development,” promises Wixler. “This enables standard products to be found and, if necessary, be adapted to individual requirements or complex products can be created – all without the need for familiarization or prior workshops.” Wixler has developed this system into a kind of social media platform for business customers. The extended platform is already online as a trading system for agricultural buying and selling. “At the moment, we are looking for partners to introduce the new trading system in the metal industry. We believe that the future of metal trading lies in an open platform and not in isolated soluitions.”

THE MACHINE ORDERS STEEL

What will the future of steel trading be like? Everyone agrees that the future of steel trading is digital, with further agreement that the winners will be the traders who have who have been quick and purposeful in the digitization of their processes.

However, it is also possible that many steel traders will no longer be needed at all in future. In the Industry 4.0 era, developments will lead to digitization of the entire supply and added value chain. In smart factories, stocks and machines are connected to each other directly via the Internet of things (IoT). If the system identifies that the steel available on the production machine is running out, an order is placed with the steel trader or directly with the steel mill. What sounds futuristic could soon become reality. At least this is what Axoom (Karlsruhe, Germany), a start-up company established by machine tool manufacturer TRUMPF GmbH + Co. KG (Ditzingen, Germany), believes. They have created a complex Industry 4.0 ecosystem, and who is their partner in this venture? The steel trader Klöckner.