Back to America: Game Over For The Global Supply Chain?

The global pandemic has revealed the fundamental flaw of relying on only one or two manufacturers of metal parts, components, and assemblies: Companies pay less up front, but are scrambling to fill their customers’ orders. Here’s how to grab your piece of the pie as U.S. companies search for local partners.

Posted: July 15, 2020

AUGUST COVER STORY

BY STEPHANIE JOHNSTON

Steel oil and gas pipes, wire harnesses for electronics, hollow-float metal balls and assemblies, quick-fit pipe connectors, wire grids, hydraulic cylinders, hydraulic excavators, gears and gearboxes, springs, electric motors, rivet nuts, custom cylindrical components, contract aluminum and zinc die casting.

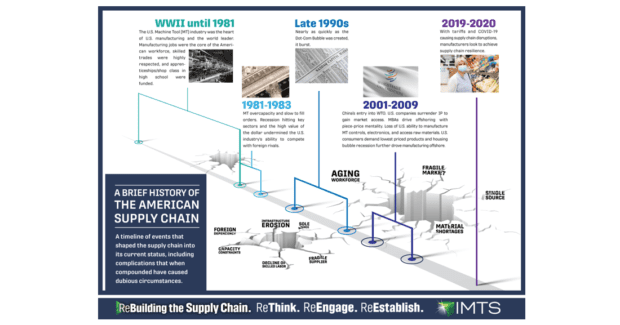

These are some metal parts and components whose production has come back to the U.S. or been kept from going overseas from 2010 to 2018, according to the Reshoring Initiative. Launched in 2010, the nonprofit consortium of trade associations and technology suppliers works to return roughly five million manufacturing jobs lost over the last two decades to the U.S.

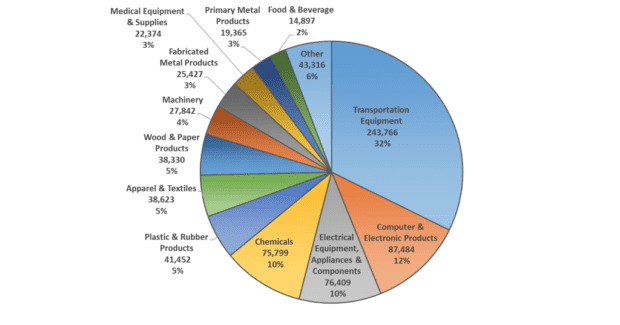

In just one North American Industry Classification System (NAICS) category – fabricated metal products (code 332) – at least 365 companies have created 25,000 U.S. jobs by exploiting their customers’ growing disenchantment with outsourcing’s consequences: poor quality, freight cost, intellectual property risk, inadequate communications, loss of control. Medical equipment and supplies (NAICS 33911), primary metal products (NAICS 331), and electrical equipment and appliances (NAICS 334) add another 612 companies and 118,148 jobs.

The global pandemic is accelerating this trend by exposing the fatal flaw of a business model that relies on working with one or two suppliers – wherever they’re located, but especially overseas: supply chain vulnerability. Decades of focusing on upfront price blinded many companies to the vulnerabilities of their sourcing strategy. These, according to the Reshoring Initiative, add 20% to 30% to a product’s price.

“The COVID-19 pandemic turned the supply chain on end. It forced manufacturers to rethink their strategy, their products, and their future,” says Lisa Anderson, president of a consulting firm that works with manufacturers and distributors to optimize supply chains. “China has fallen from favor due to COVID-19 and the arduous policies they implemented early in the year that essentially removed all protections of intellectual property and patents. There’s been talk about doing more business with Mexico, but Mexico is best at assembly.

Companies that took the time to identify opportunities and used this unique circumstance to leverage technology and innovate are already seeing results.”

U.S. citizens and the federal government are happily helping.

More Support Than Ever for Bringing It Back Home

In early May, according to IndustryWeek, the manager of the madeinamerca.co website reported inquiries for U.S.-made products rose 825% from March 26 to April 22. The manager of another website, MadeInAmerica.com, reported 2,000% increase in inquiries.

According to an FTI Consulting poll conducted at around the same time, 40% of Americans won’t buy products made in China; 22%, India; 17%, Mexico; and 12%, Europe. Almost 80% said they’d pay more for domestically produced goods.

The article quotes Atlas Tool & Die Works Inc. Chief Alignment Officer Zach Mottl as saying, “The COVID pandemic has been tragic for many reasons. If we can find a way to move forward, it’s to stop being so reliant on a country, like China, that doesn’t have our best interests at heart.” The Lyons, Ill., manufacturer of metal parts for the aerospace, consumer products, defense, medical, and telecom industries reported that orders were 1.5 times the company’s usual volume.

The U.S. government has been supporting reshoring for at least three years.

In 2017, President Donald J. Trump signed an executive order tasking a Defense Department Interagency Task Force to assess and strengthen manufacturing and defense supply chain resiliency, including machine tools and industrial controls. A year later, the White House Subcommittee on Advanced Manufacturing released a plan for renewing such strategically important sectors as communications and computers.

When news of a new virus began filtering out early this year, the U.S. was initially so unconcerned that we’d shipped 18 tons of personal protective equipment (PPE) to China by Feb. 7. Little over a month later, on March 27, the president signed the largest economic stimulus package to date, the $2 trillion Coronavirus Aid, Relief, and Economic Security (CARES) Act. On May 14, he signed a two-year order authorizing the U.S. International Development Finance Corporation to make Defense Production Act loans. On June 22, the Defense Department announced it’s going to use $100 million of its CARES Act funding to subsidize federal loans to companies making goods for the pandemic response.

Meanwhile, some U.S. metal manufacturers were fielding calls from established local customers as well as companies trying to plug supply gaps caused by Chinese factory shutdowns. Somehow, despite state stay-at-home mandates, confusion over how best to protect employees whose work can’t be done remotely, and a reduction in workforce as employees stayed home to care for children and elderly family members, they managed to maintain production levels. Deemed essential businesses, they couldn’t afford not to.

Reshoring Q&A: How to Take Advantage of a Crisis

In June, JM Performance Products Inc. President John Stoneback interviewed the Reshoring Initiative’s Harry Moser on pre- and post-pandemic manufacturing considerations.

Located in Fairport Harbor, Ohio, JM Performance Products makes CNC mill spindle-optimization products such as a high-torque retention knob that overcomes the “loose-tool” design flaw inherent in v-flange tooling. The company has manufactured for more than 65 years without relying on foreign support.

Stoneback: How does the pandemic affect the global supply chain?

Moser: Having relegated the supply chain to China for the better part of the past decade, some companies started taking steps last year to divest their over-reliance on Chinese parts. This was prompted by the trade war. Some companies shifted low-cost parts acquisition to Vietnam and others to Mexico.

Trade as a percentage of world gross domestic product (GDP) over the last three to four years was plateauing before the pandemic. Companies were beginning to realize that depending on other countries wasn’t the economic or ‘green’ solution for the long term. So the focus was already trending toward localization and regionalization.

According to our research, manufacturing jobs via reshoring grew to 180,000 in 2017, the fastest rate in history. That’s up 50% from 2016 and 2,800% from 2010. This must continue after the pandemic, with the U.S. outsourcing more from Mexico versus China if domestic isn’t an option.

Stoneback: How does the pandemic differ from crises like 9/11 and the 2008 recession?

Moser: The Reshoring Initiative began in 2010, so 9/11 didn’t directly affect it. However, on the international market, import and export regulations can always be a hurdle for finding the right suppliers. This was especially true for U.S. businesses after 9/11. The extra time and money spent on certifying a supplier for regulations like the Customs Trade Partnership Against Terrorism (C-TPAT) is another tradeoff that management must consider when diversifying their supply chain.

The financial crisis drove OEMs to essentially not buy anything. On-hand plus pipeline inventory from Chinese suppliers might total three to six months’ usage; if you get it locally, it’s three to six weeks. Additionally, big companies are more resilient and can handle the problem of low sales much better. China pays in advance and the U.S. pays 60 to 90 days after shipment, so there’s more control during a disaster.

Developing domestic partnerships is the new reshoring. In most cases, customers will pay a premium for on-time, as-promised delivery. The goal is to convince companies to do the math and decide what to reshore now.

Stoneback: Which markets would benefit most from reshoring?

Moser: Product shortages due to 90%-to-95% dependence on imports (especially from China) make the medical and pharmaceutical markets the top-priority targets. The global supply chain must be replaced with local and national sourcing, but not just in health care. Other industries include transportation equipment, appliances, plastic and rubber products, fabricated metal products, electronics, and apparel.

Medical supplies accounted for roughly $53 billion worth of U.S. imports last year. Reshoring production for half could generate an additional 302,000 jobs and add $534 billion to the GDP.

Stoneback: How can U.S. manufacturers positively frame the reshoring equation?

Moser: Companies that reshore accept a higher U.S. cost but reduction in overhead (inventory, travel, international property, etc.). The bottom line is to reshore the products where the savings on overhead and risk is greater than the increase in manufacturing cost.

To do that, you have to measure costs correctly. Calculate factors like duty freight, cost of inventory, travel, etc., and see how they impact a product’s true cost. You can also factor in savings from government initiatives such as tariffs, as well as cost savings from production efficiencies.

Stoneback: The U.S. mold-making industry took a heavy hit from offshoring. Reshoring would allow for higher quality, longer life, and faster response to opportunities. Reducing production and transportation costs would put mold makers in a stronger competitive position.

Sidebar

Steal This Idea: One Company’s Response

“The global pandemic isn’t causing reshoring; it’s accelerating it,” says Reshoring Initiative President Harry Moser. He founded the initiative after spending 25 years as North American president and chairman emeritus of EDM machine tool builder GF AgieCharmilles (now GF Machining Solutions). “This is an excellent time for your readers to grab work before it goes to Cambodia, India, Malaysia, Vietnam, etc.”

Franklin Bronze Precision Components LLC in Franklin, Pa., is using initiative resources such as a free total cost of ownership (TCO) calculator at www.reshorenow.org to persuade potential customers. Located about 90 minutes from Pittsburgh, the company makes investment castings for glass containers, pumps and valves, steel, automotive, and food processing.

“When evaluating a local supplier, companies should look at total cost, including transport, duty, freight, carrying cost of inventory, quality, and delivery, rather than simply labor costs as happened in the 1990s offshoring wave,” says Industrial Sales Manager Kevin Weaver in a company blog about reshoring. “Having suppliers close to home eliminates much of this extra cost and logistical headache and provides opportunities to customize products.

“We offer speed to market and close collaboration with our customers, an advantage for those looking to reshore. With robotic processes, in-house tooling and castings machining, we are able to react and deliver parts fast.”

Sidebar

Three Sources of Reshoring Support

In addition to a free total cost of ownership calculator, the nonprofit Reshoring Initiative offers two paid programs:

- Supply Chain Gaps Program identifies products with high imports and no domestic sources so U.S. companies can become the only producer.

- Import Substitution Program identifies major importers and helps U.S. suppliers convince importing companies to source from them.

For more information, contact Harry Moser at harry.moser@reshorenow.org; 847-867-1144.

- Part of the U.S. Commerce Department, the National Institute of Standards and Technology’s public/private Manufacturing Extension Partnership (MEP) has centers in all 50 states and Puerto Rico dedicated to serving small- and medium-sized manufacturers. Last year, interactions with 28,213 manufacturers resulted in $15.7 billion in sales, $1.5 billion in cost savings, $4.5 billion in new client investments, and helped create or retain 114,650 jobs. Visit www.nist.gov/mep.