Why You Should Have a Secondary Financial Partner

Building a relationship with a secondary financial partner keeps your business in a healthy financial position should your primary partner discontinue your relationship.

Posted: February 12, 2023

PROFIT MASTERY

Many manufacturing companies have only one banking and financial partner. This typically includes cash management services such as a checking or savings account, a line of credit, and often some type of term loan, either for real estate or equipment, depending on the type of business and the assets employed by the business.

Having a singular relationship may help create a stronger relationship and sometimes allows you to negotiate deeper discounts or improved services. But what happens if that one financial partner decides they will no longer provide one or more of the services you’ve come to rely upon? This can happen for a variety of reasons:

- A banking partner discontinues financing in a specific industry

- The company runs into some financial stress and no longer meets all the bank’s covenant requirements

- A banking partner calls or refuses to renew a line of credit, effectively cutting off access to capital, and sometimes demanding immediate repayment of any outstanding balances

- The banking or finance partner feels the relationship is getting too large and isn’t willing to extend additional credit

- A financial partner is purchased by another entity and the buyer doesn’t want business in a specific industry

When your sole finance partner tells you they can no longer help you, it can destabilize your business, especially if you are in a down cycle or in some form of financial decline, even if temporary. In addition, depending on timing, it can become difficult to find a replacement partner.

That’s why we recommend building a relationship with a secondary financial partner early in the life cycle of your business. If nothing else, a secondary partner gives you an additional resource, allows you to do some price comparisons, and puts you in a better position should you have any future issues.

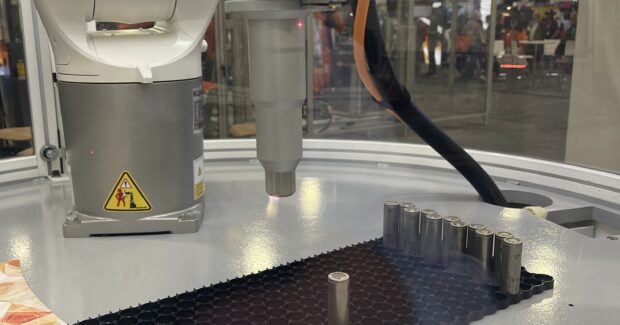

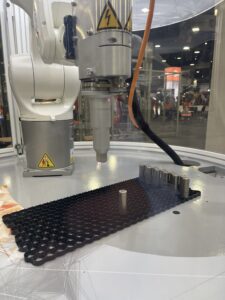

Manufacturers Capital, a division of Commercial Credit Group, is not a bank. We do not provide the cash management services the banks can. But our wide range of services, including equipment financing for fabricating and metalworking equipment, debt consolidation loans and working capital loans, can help you when you need to reduce monthly expenditures or need cash for opportunities or emergencies. We can also move quickly to structure financing to meet your needs and get you the equipment you need when you need it.

What should you look for in a secondary financial partner?

What should you look for in a secondary financial partner?

Find a partner that understands your industry. Face it, the typical banking relationship that consists of checking and savings accounts doesn’t really require the bank to know your business or understand your industry. But when it comes to obtaining the capital you need to acquire new equipment and technology, a partner that knows the equipment you are purchasing can be invaluable.

When you work with a lender that knows the equipment you are buying, it can be easier and quicker to close on the loan. If the lender is familiar with the equipment, they can structure a deal to meet your needs. Their underwriters know how to assess the equipment, and they can often tell if you are getting a good or a at least a fair deal on the equipment. What’s more, they understand any ancillary costs or charges (accessories, installation costs, etc.). In some cases, banks won’t finance some equipment simply because they don’t understand it and don’t recognize the value of the equipment or its value to the business.

Find a partner that is committed to your industry. Some banks move in and out of certain industries as the economics of these industries go through their natural cycles. This can be difficult for many companies because they are kept guessing as to when a bank might be willing to finance equipment. Spending time gathering information for the bank, only to have them take a week or more to review and then tell you they don’t have the stomach to finance in your industry is frustrating and time consuming.

Find a partner that is committed to your industry. Some banks move in and out of certain industries as the economics of these industries go through their natural cycles. This can be difficult for many companies because they are kept guessing as to when a bank might be willing to finance equipment. Spending time gathering information for the bank, only to have them take a week or more to review and then tell you they don’t have the stomach to finance in your industry is frustrating and time consuming.

We recommend you have at least one financial services provider that is committed to the fabricating and metalworking industry. This ensures that they understand the nuances and economics of running a fabricating shop and have a great deal of experience financing the type of equipment you use and need to keep your business moving forward.

A knowledgeable finance partner knows the right questions to ask, in many cases knows where to get those answers, and can help guide you through the financing process. You owe it to yourself and your company to seek a secondary partner, if for no other reason than to have a resource should things go sideways with your primary lender.

{Call out}

You should have at least one financial services provider that is committed to the fabricating and metalworking industry. This ensures that they understand the nuances and economics of running a fabricating shop and have a great deal of experience financing the type of equipment you use.

Subscribe to learn the latest in manufacturing.